6 4: Comparing Absorption and Variable Costing Business LibreTexts

The amount of under-absorption is added to the cost of items created and sold if the actual output level is less than the normal output level. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

- The variable cost per unit is \(\$22\) (the total of direct material, direct labor, and variable overhead).

- Write your cost formula and plug in the number of units sold for the activity.

- Unlike variable costing, it covers fixed costs and inventories while calculating the cost per unit.

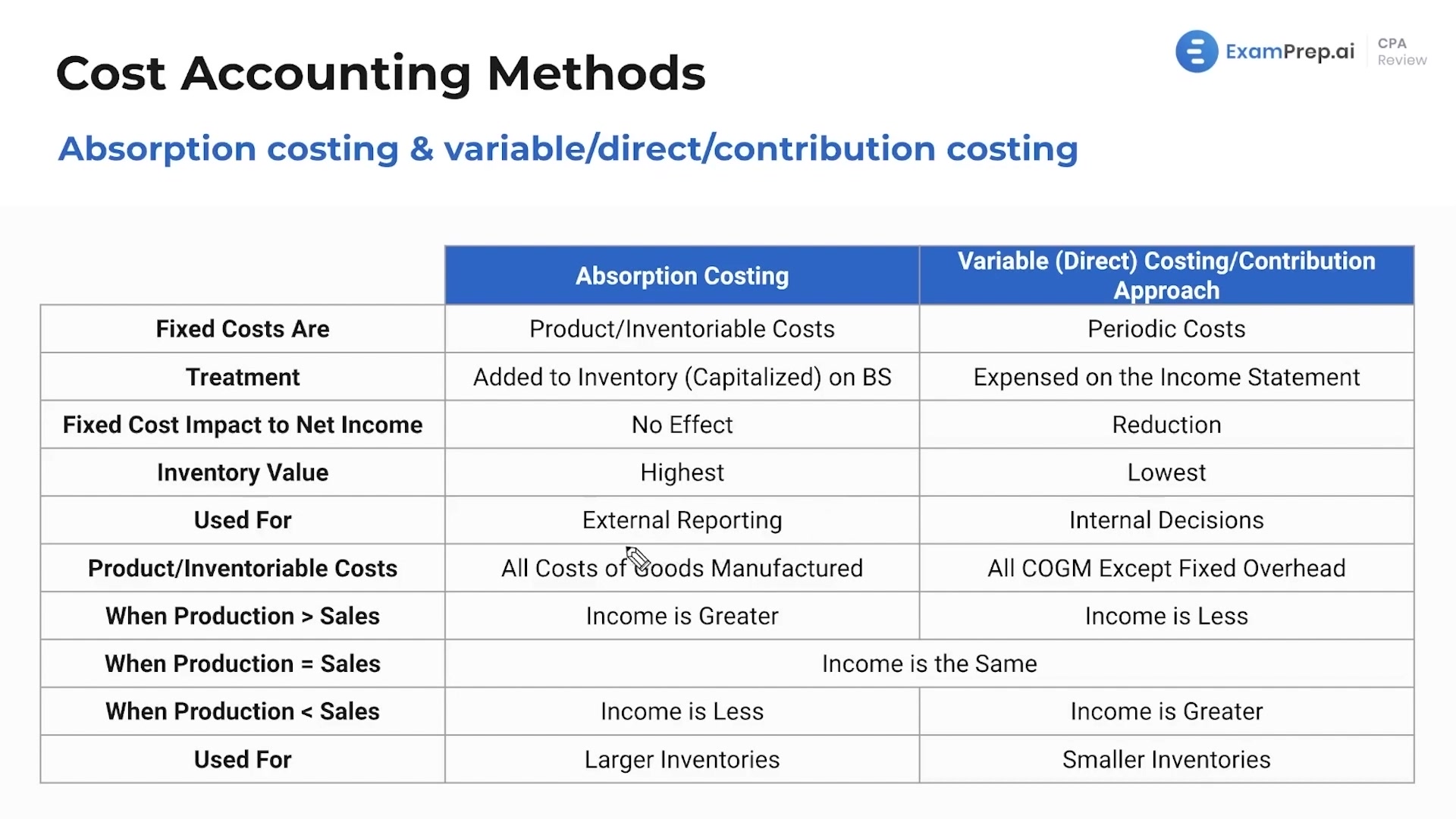

What’s the Difference Between Variable Costing and Absorption Costing?

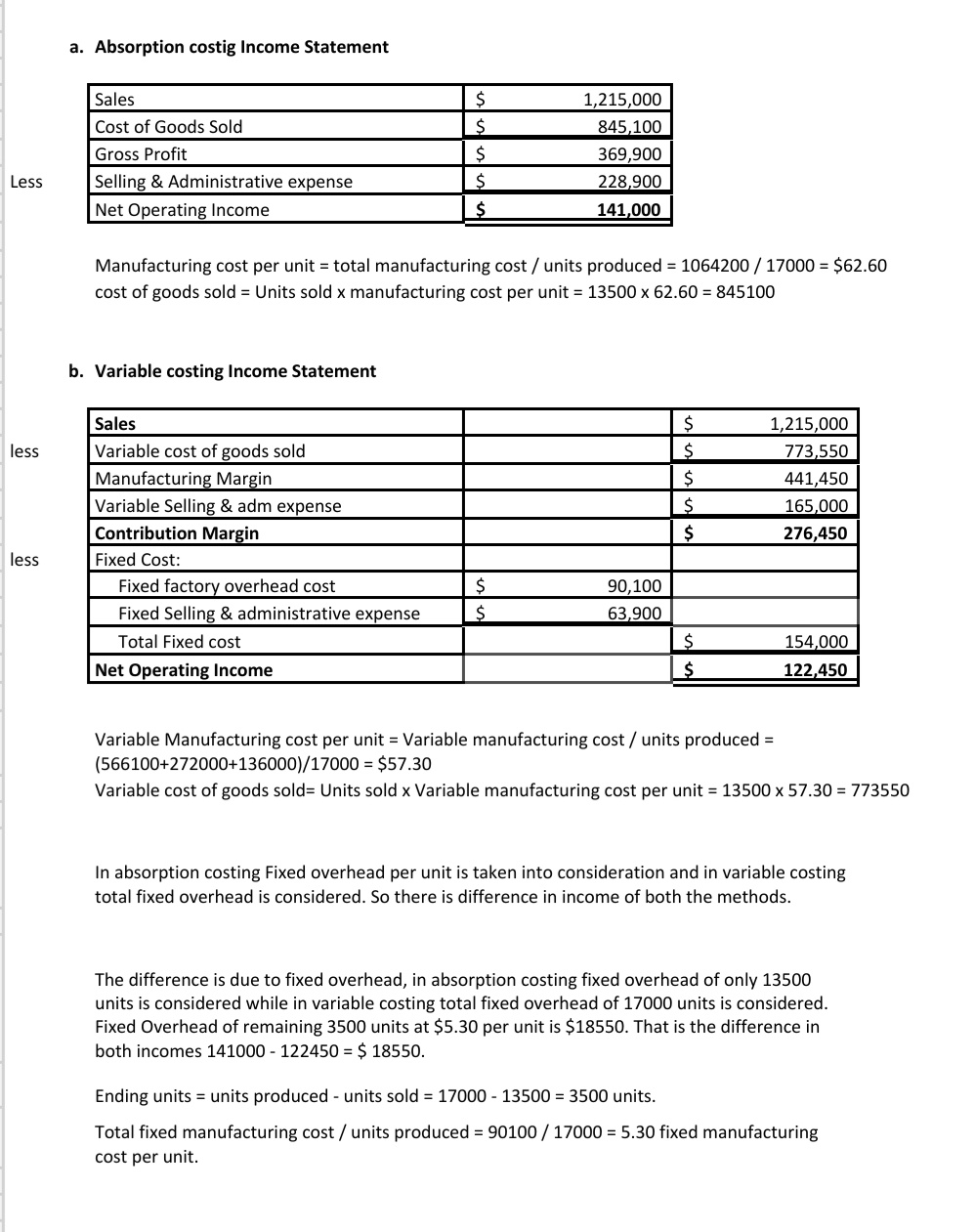

Absorption costing, also called full costing, is what you are used to under Generally Accepted Accounting Principles. Under absorption costing, companies treat all manufacturing costs, including both fixed and variable manufacturing costs, as product costs. Remember, total variable costs change proportionately with changes in total activity, while fixed what is an invoice costs do not change as activity levels change. These variable manufacturing costs are usually made up of direct materials, variable manufacturing overhead, and direct labor. The product costs (or cost of goods sold) would include direct materials, direct labor and overhead. The period costs would include selling, general and administrative costs.

Introduction to Absorption Costing in Accounting

Since 2014, she has helped over one million students succeed in their accounting classes.

Absorption Costing And Variable Costing.

To complete periodic assignments of absorption costs to produced goods, a company must assign manufacturing costs and calculate their usage. Most companies use cost pools to represent accounts that are always used. It is very important to understand the concept of the AC formula because it helps a company determine the contribution margin of a product, which eventually helps in the break-even analysis. The break-even analysis can decide the number of units required to be produced by the company to be able to book a profit. Further, the application of AC in the production of additional units eventually adds to the company’s bottom line in terms of profit since the additional units would not cost the company an additional fixed cost. As you can see, by allocating all manufacturing costs to inventory, absorption costing provides a more comprehensive assessment of profitability.

How Is Absorption Costing Treated Under GAAP?

Let us understand the concept of absorption costing equation with the help of some suitable examples. Managers can manipulate income by changing the number of units produced Producing more products gives a higher income. Absorption costing results in a higher net income compared with variable costing. It identifies and combines all the production costs, whether Variable or Fixed. Once the cost pools have been determined, the company can calculate the amount of usage based on activity measures. This usage measure can be divided into the cost pools, creating a cost rate per unit of activity.

Reconciliation between absorption costing and variable costing

However, absorption costing depends heavily on cost estimates and output assumptions. In summary, absorption costing provides a comprehensive look at per unit costs by incorporating all expenses related to production. The tradeoff is that net profit fluctuates more than with variable costing methods. Understanding these basics helps explain the meaning and utility of absorption costing.

Because fixed costs are spread across all units manufactured, the unit fixed cost will decrease as more items are produced. Therefore, as production increases, net income naturally rises, because the fixed-cost portion of the cost of goods sold will decrease. The components of absorption costing include both direct costs and indirect costs. Direct costs are those costs that can be directly traced to a specific product or service. These costs include raw materials, labor, and any other direct expenses that are incurred in the production process.

Having a solid grasp of product and period costs makes this statement a lot easier to do. Calculate unit cost first as that is probably the hardest part of the statement. Once you have the unit cost, the rest of the statement if fairly straight forward. Using the cost per unit that we calculated previously, we can calculate the cost of goods sold by multiplying the cost per unit by the number of units sold. Absorption costing is typically used in situations where a company wants to understand the full cost of producing a product or providing a service. This includes cases where a company is required to report its financial results to external stakeholders, such as shareholders or regulatory agencies.

Using the absorption costing method on the income statement does not easily provide data for cost-volume-profit (CVP) computations. In the previous example, the fixed overhead cost per unit is \(\$1.20\) based on an activity of \(10,000\) units. If the company estimated \(12,000\) units, the fixed overhead cost per unit would decrease to \(\$1\) per unit.