Is it Best that you Co-To remain A mortgage?

What is actually Co-Signing A mortgage?

So you’re able to co-signal a home loan will be to put your label towards home financing while the a hope facing an effective loan’s number 1 borrower failing woefully to keep with money.

However, in the modern home loan environment, the requirement to co-sign is close to nil. There are lots of in today’s market getting people from all borrowing products; and you will, are very low that the hurdles so you can homeownership keeps dropped.

And, that have lenders loosening loan guidelines across the country, much more mortgages are receiving recognized than simply during people period that it a decade.

It is far from that co-signing is actually an awful idea, by itself – it’s just you to co-finalizing towards the that loan can be unnecessary to suit your type of home loan condition.

Co-signing Home financing: Your very best Instance Circumstances

The most effective need to add a beneficial co-signer to the financial would be to qualify for that loan one to you can if you don’t not score.

This may imply providing entry to all the way down financial costs, increased amount borrowed, yet another loan program like the , otherwise most of the over.

Inside the a best-case co-signing circumstances, the key mortgage borrower becomes accepted due to their finest loan it is possible to into co-signer’s name connected.

Upcoming, at some stage in the long run, the borrowed funds is refinanced into the prie only, and this frees the fresh new co-signer of its debt toward mortgage.

In this co-signed several months, the primary borrower produces the mortgage payments into-time; and you can, because a beneficial co-signed financial comes up on credit history out of both parties, the new co-signer doesn’t have a need to apply for its own financial.

Co-signing A home loan: Your own Worst-Case Scenario

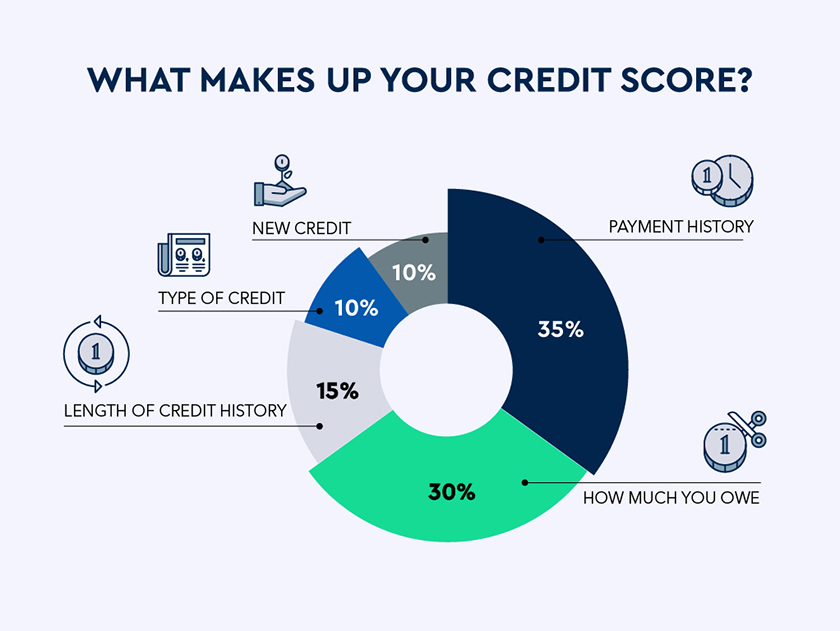

Once the both parties is actually just as obligated to the mortgage together with bank, a missed mortgage payment damages a couple mans borrowing – not just one. Your credit rating can be drop more than 100 circumstances to have an skills in that way.

Shed another mortgage repayment is worse. And you can, since the a co-signer, you likely would not learn there clearly was a problem:

- You’re not one composing month-to-month checks into lender

- You aren’t the main one the financial institution calls when there was an overlooked commission

- You aren’t the one who has the see when the financing gets into standard

Because a good co-signer, an important borrower’s standard becomes the default, as well, and that foreclosure remains in your credit file for up to seven decades.

The new Non-Renter Co-Borrower Alternative

A low-renter co-borrower is an individual who are co-credit towards the property, although not living in it. Non-tenant co-individuals is actually a step above co-signers – they’ve been partners on residence’s control.

Home loan costs to have loans that have a non-renter co-borrower are typically more how to get loan in Ken Caryl than cost for a co-finalized mortgage, but for the supplementary team, being a low-tenant co-borrower feels significantly more secure.

As a non-occupant co-debtor, you have made an identical sees since borrower so you understand if they are not paying punctually; and you can, you add oneself positioned to make a home income in the event that the main borrower is not rewarding their requirements for the arrangement.

Once you make an application for your financial, merely give the lender that you’ll be playing with a non-renter co-borrower with the loan. The bank will know how to handle it.

Options So you’re able to Co-Signing A home loan

And numerous reasonable- no-deposit funds available for the present buyers out of home, there are down payment and you can closing cost guidance apps to aid first-go out homebuyers or any other homebuyers access financial credit.

- of a member of family

- This new HomeReady mortgage

- A great

The aforementioned applications address a broad-selection of house buyer demands plus help for these with little or no currency to have a downpayment; that have reduced-to-modest money profile; which have a great thin credit history; and you will, with a few blemishes facing its credit history.

Exactly what are The present Financial Prices?

If you’re planning so you’re able to co-sign on a home loan, it’s important to understand the risks – in order to remember that you will possibly not need to co-to remain that loan anyway.

Get today’s live mortgage pricing today. Their societal protection number isn’t needed to begin with, and all sorts of quotes have access to your own live financial credit scores.