Ought i Release My personal House Guarantee Loan when you look at the Bankruptcy proceeding and keep maintaining My Home?

Can be a house Collateral Line Become Discharged from inside the Bankruptcy?

A home equity line of credit (HELOC) is different than simply a property security loan. Of several listen to the term home guarantee and you can incorrectly believe that a person is a different title to your most other. Property security financing is actually a predetermined loan to possess a certain and you may unchanging sum of money. A property guarantee line, likewise, is a line of credit that may enjoys an optimum mark, although money is lent with the a towards-requisite basis.

This means that, while to buy an excellent $500,000 house, a good HELOC creditor is generally happy to progress you around $five-hundred,000 you commonly fundamentally necessary to borrow the whole number at the same time because you create which have property collateral loan. HELOCs may also be used for other intentions aside from paying down financial costs. This line of credit is secure just like the a great lien on the house.

While immediately following, HELOCs were used nearly simply for second mortgages, it is almost all the more well-known discover them used to possess earliest mortgage loans. Both HELOC can be used so you can refinance basic mortgage loans.

HELOCs have numerous masters. For those needing to create big renovations or create severe repairs so you’re able to a house, HELOCs let them mark around they want rather than overdrawing on the a costs you may not know the price of initial. One can use them to pay credit cards or other month-to-month expenditures.

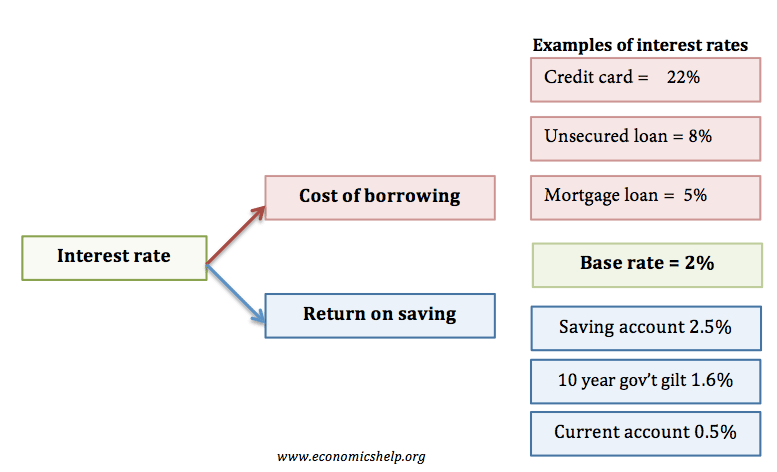

HELOCs provides an important likelihood of erratic interest rates. Business demands affecting other areas out-of a home is also drive up the eye pricing out-of HELOCs more. This is one way a lot of people discovered themselves in trouble during the new casing bubble. A great HELOC lender possess a straight to reduce a credit line which is just what of many loan providers performed due to the fact construction beliefs easily denied.

Discharging HELOC inside the A bankruptcy proceeding

You might launch the HELOC when you look at the Chapter 7 exactly what you will be actually discharging is your responsibility to repay the debt. Notably, HELOCs is actually safeguarded against the security of your house making the fund secured rather than unsecured. Like all other secured personal loans, Chapter 7 discharges your own responsibility to settle the mortgage but that cannot make possessions about what you borrowed from the debt due.

A bit of records. In the property bubble, of a lot property owners took away family guarantee personal lines of credit (HELOC). Because ripple burst, they struggled making money on their HELOC loans and you can were being unsure of whether it happened to be value due to the fact the value of their house had plummeted. Of several loan providers block HELOC finance that was within their courtroom correct. So it left property owners rather than a safety net to get them owing to the most difficult a portion of the credit crunch. The effect was a great amount out of property foreclosure related to HELOCs.

Which brings us to possibly the very clicking matter: Normally a home equity range feel released from inside the Chapter 7 bankruptcy proceeding? The clear answer yes. Should i keep my personal family?

Family Collateral Fund and you may Bankruptcy proceeding

From inside the growth, of many property owners grabbed away home collateral credit lines (HELOC) consequently they are today incapable of pay back those financing also its financial. Is a borrower release the HELOC in the Chapter 7 bankruptcy proceeding and you may remain their residence? The brand new quick answer is no. A borrower is release the home collateral loan when you look at the Chapter 7 bankruptcy nonetheless they don’t release they And keep their property.

However, when the a borrower wants to keep their home, they’re able to in order to document Section 13 bankruptcy proceeding and you can pay off both its HELOC as well as their original site mortgage more a 3 to 5 12 months months. If the, shortly after completing their Section 13 case of bankruptcy fees package, there was an equilibrium on your HELOC loan you to definitely ount your pay on the bank.