Such as for instance: In the event the, shortly after 5 years out-of paying your own $five-hundred,000 mortgage at step 3

Repaying the loan ultimately

Should your rates of interest go lower due to behavior by the lender, then you may take pleasure in purchasing reduced within the monthly mortgage repayments or continue expenses your residence loan within latest payment add up to lessen full focus paid back.

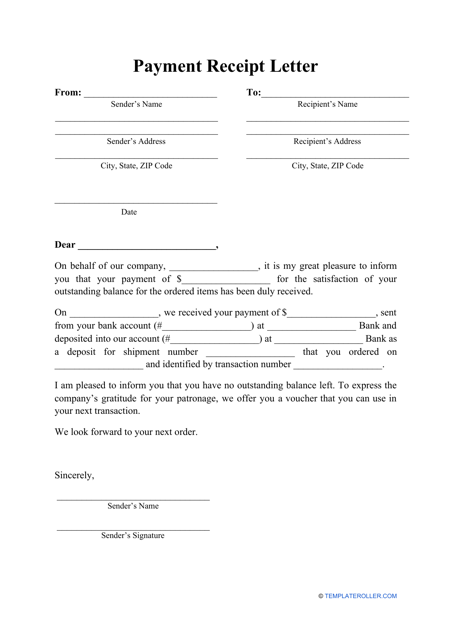

00% p.a great., you may have refinanced your current prominent off $444,531 for two.75% over 25 years. Their monthly costs try $2,051, a saving from $57 a month. However, for individuals who manage a repayment regarding $dos,108, you will save a supplementary $seven,159 and you may several months out of your financial. Here its for the an easy desk.

Refinancing immediately following 5 years from repaying an effective $five hundred,000 mortgage at 3.00% p.a beneficial. The borrowed funds number is starting to become $444,531 in addition to left identity 25 years.

Refinancing should be an effective way to accelerate this process. In search of a better home loan rate and you can improved payment allowances (eg no costs for additional money otherwise maximums) could get your home mortgage out of your lives actually sooner. As well as get noticed significantly more than, for many who be able to re-finance to dos.50%, a speed fifty basis activities below step three.00%, then you can save your self a considerable $46,347 into the attract and you can shave nearly 24 months of your own mortgage label.

Adding has actually and you may independence

The rate isn’t the only basis out of a house loan take into consideration. Some low-rate money do have more fees, faster provides otherwise stricter standards from financing payments. Almost every other financing items offer a heightened a number of have like offset account and you may redraw place, which give autonomy and you will possibilities to reduce the full attention repaid. Certain financial packages tend to be lower-rate/low-commission playing cards otherwise several profile-one to yearly payment activities.

Like everything you, there was essentially a price to invest with have and solutions, either a high rate of interest and/or maybe more charges. It means you could pay more than asked toward domestic loan along side long lasting. This is why it is important to utilize the latest Investigations Speed when you compare home loans.

Offset AccountThis are a discount or exchange account where account harmony is actually deducted from the balance of your house financing on the amount of time interest is calculated for this months. Eg, you have been expenses their $five-hundred,000 mortgage during the step 3.00% p.a. for five age in the $dos,108 30 days.

During the time of your upcoming payment, their dominant might possibly be $444,531 and the number paid-in focus regarding day create getting $step 1,111. Should you have an offset membership that have $50,000 deals with it, after that that will be subtracted from your own home loan equilibrium for brand new purposes of calculating your attract. The principal would efficiently become $394,531 plus the desire payable will be on $986. That is a saving out-of $125 in that times.

Home loans that have counterbalance institution will often have a higher level of interest than simply basic mortgage brokers, but they are specifically of good use when the money from various other supply was striking the latest account: other wages, assets, rents, a good windfall an such like.

Redraw FacilityA redraw business enables you to redraw a portion of even more loans you may have paid down to your house mortgage ahead of the repayment agenda. Instance, if you find yourself $29,000 ahead and want to remodel the restroom to possess $20,000, 5000 dollar loan poor credit Columbus then you may possibly redraw those funds to pay for the new repair. When you have not been getting attract toward the individuals deals, you have been protecting on attention youre purchasing towards your property loan, that is constantly greater than most rescuing levels.

Redrawing can sometimes bear a fee, therefore speak with your own financial regarding options. Having IMB customers redrawing playing with web sites banking will not sustain people fee.