In case your mortgage loan try kept otherwise serviced of the a special York-controlled establishment, you can be entitled to forbearance

Download a PDF Adaptation

- Just what are my personal choice easily dont make my personal month-to-month home loan costs?

- What exactly is Forbearance?

- What will happen when the forbearance comes to an end?

- How do i see if We have a federally supported mortgage?

- Are there other choices in addition to forbearance arrangements?

- When can be my personal lender start a property foreclosure step?

- I have a public auction day scheduled. What should i anticipate?

- In advance of , We gotten a good Summons and you will Complaint and other documents you to definitely say I need to answer otherwise come in courtroom. What ought i do?

- We have an opposing home loan. Just what should i perform easily in the morning not able to spend my personal assets taxes?

- In which can i find out more about programs to help people using anyone health emergency?

What exactly are my personal choices basically don’t make my month-to-month home loan repayments?

For those who have sustained monetaray hardship while the start of COVID-19 pandemic, you are likely eligible for forbearance for making mortgage repayments having up to 360 days.

Most residents enjoys federally recognized mortgages. If you find yourself one of them, you can ask your servicer having good forbearance all the way to 180 months. This new forbearance are extended to own a supplementary 180 months.

Whether your financial is not federally supported and not serviced by a ny-regulated entity, you may still find an excellent forbearance, but the size and you will conditions could be place of the entity upkeep the mortgage. It could be wise to expected good forbearance in writing, determine it is about the general public wellness emergency, and maintain a duplicate of page together with evidence of delivering (if or not of the mail, facsimile, otherwise email address).

When your financial will not leave you forbearance get in touch with Nassau Suffolk Laws Qualities from the (631) 232-2400 (Suffolk) or (516) 292-8100 (Nassau), yet another legal advice supplier, a non-profit houses counselor, or even the Ny County Attorney General’s workplace on step 1-800 771-7755.

What is Forbearance?

Forbearance delays the brand new due date for the mortgage payments. Forbearance is not forgiveness. You are still responsible for costs missed during the forbearance.

The government CARES Work and you may Nyc County Laws passed as a result to COVID-19 prohibit later charge and you can charges not in the interest determined as the when your repayments have been made promptly. Forbearance plans maybe not susceptible to the new CARES Operate or NYS laws vary from late costs and additional notice charge.

Escrow prices for assets fees and you will/or assets insurance coverage aren’t payday loans County Line, AL online at the mercy of forbearance. Whether or not property fees may not be owed for several days shortly after new forbearance period initiate, mortgage servicers are required to guarantee you will find sufficient on your escrow account about whole seasons and will require continued payment of the taxation and you can/otherwise insurance coverage part of the month-to-month homeloan payment in forbearance several months.

What takes place if the forbearance concludes?

Residents that have federally supported mortgage loans and the ones serviced by the NYS controlled associations have the option to choose whether to extend the loan label towards duration of the forbearance period (incorporating what number of months of your forbearance into prevent of the loan name), decide to bequeath forbearance payments each month toward remaining financing title, otherwise present a low-attention affect balloon commission after the borrowed funds term on the forbearance count.

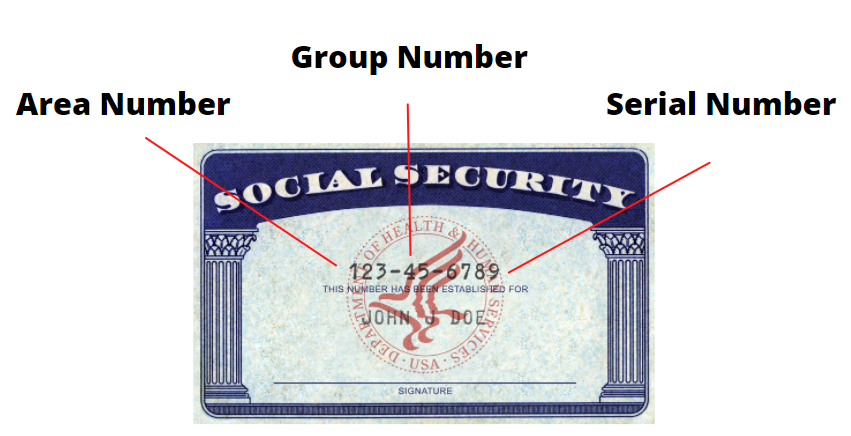

How can i know whether You will find an effective federally recognized home loan?

Really federally-backed mortgage loans try owned by Fannie mae or Freddie Mac computer, secured otherwise insured because of the HUD (FHA), and/or Va. Fannie mae and you may Freddie Mac computer have online financing lookup-up tools having people understand whether either of them authorities-backed organizations currently is the owner of your loan.