Kansas Very first-Date Homebuyer Software You must know In the

Dining table of Material Mask

Looking property from inside the Kansas are pleasing, nonetheless it can also be challenging. There are so many facts to consider while looking for the earliest house, such as the cost of land in different parts and just what variety of help is open to very first-go out customers.

In this post, we will talk about the different features out of Ohio’s basic-date homebuyer software as well as how it works. We are going to as well as look at the latest homes trend for the Ohio’s major elements and provide strategies for properly dealing with a mortgage. Finally, we shall focus on a few of the professionals one very first-day home buyers score after they purchase a home for the Ohio.

Very whether you’re starting to mention your own homeownership options or if you are prepared to get your very first domestic today, this web site article is for you!

Popular features of Ohio Basic-Big date Homebuyer Applications

Ohio Basic-Time Homebuyer Software provide a lot of advantages to earliest-big date buyers along with down payment advice, low-interest rates, and versatile credit criteria. Deposit guidelines apps helps you coverage new upfront will set you back of getting property, if you are reasonable-rates will save you cash on the monthly mortgage payments. While you have specific autonomy on the credit rating, discover apps offered which can allow you to nevertheless qualify for a primary-day domestic visitors program.

How do Ohio First-Day Homebuyer Apps Performs?

While considering purchasing your first domestic from inside the Ohio, there are numerous items you should know about how these types of applications works.

- Extremely very first-time homebuyer applications require that you bring a great homebuyer knowledge group. That it class visit our web site teaches your regarding different aspects of getting a property, out-of securing financing to help you closing in your brand new home. Taking which class is a superb treatment for find out more about the procedure and make sure you are prepared for all the of your own methods on it.

- First-Day Homebuyer Software often have money constraints. Consequently discover a max family earnings you makes but still qualify for the application. The cash restrict changes according to program, but it’s basically ranging from 80-120% of city average money. When you are considering obtaining one among these applications, be sure to check the earnings standards basic.

- Really first time buyers home apps need you to possess a beneficial certain amount of cash saved having a deposit. The newest deposit conditions differ with respect to the system, however they are normally ranging from about three and four per cent of your own cost of the property. If you don’t are able to afford spared to possess a lower commission, you can find apps offered that will help using this type of since the really.

Current Homes Trend when you look at the Ohio’s Significant Section

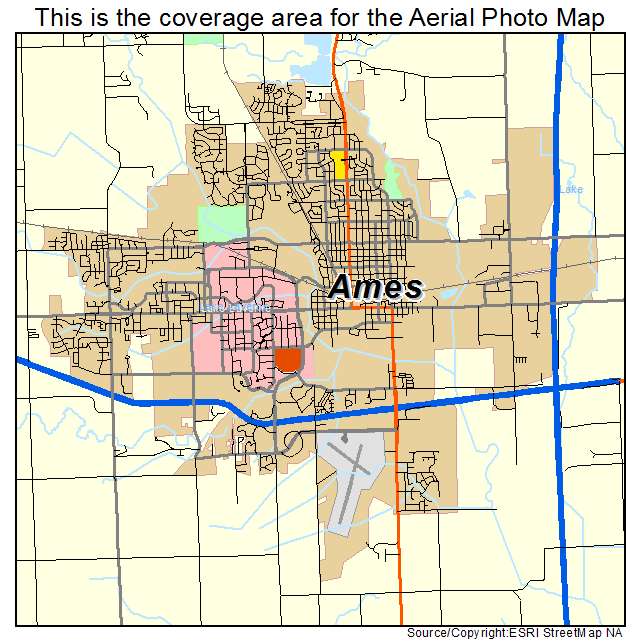

Since we’ve protected some of the rules on First-Go out Homebuyer Apps within the Kansas, let’s examine current housing manner into the Ohio’s major section. Predicated on Zillow, the brand new average house really worth in Kansas are $212,539. This will be a great 0.77% improve from just last year, and you can costs are likely to rise several other 0.36% next season.

In Columbus, the newest average family worthy of was $219,100, that’s a 0.78% raise of a year ago. Home prices in Cincinnati have raised 0.85% for the past seasons in order to an average property value $197,2 hundred. Lastly, inside Cleveland, the fresh median domestic well worth is $161,700 that’s an excellent 0.72% fall off away from history year’s well worth.

Techniques for Efficiently Handling a mortgage

If you’re prepared to buy your very first household when you look at the Kansas, well done! Running your home is a huge accomplishment and it will getting a very rewarding sense. However, it is vital to remember that owning a home is sold with certain commitments. One particular obligations is actually managing their home loan repayments. Here are some ideas for properly controlling their financial: