Regulatory Alter Expected to Increase Usage of Capital to have Are made Belongings

Position modernize Name I, truly the only federal system worried about safe, affordable house-just financing

- Desk from Contents

Brand new White Domestic; the Federal Casing Administration (FHA); and you may Ginnie Mae, the us government-had guarantor out-of federally covered lenders, announced into Feb. 30 very important changes towards Term We lending program to improve use of secure, affordable fund with the acquisition of were created land.

Are designed homes-progressive mobile homes designed to a specific federal fundamental-can help to save consumers upward of $100,000 compared with homes built on-site. Making more are available house readily available has been a button element of the fresh White House’s Houses Supply Plan, having officials noting the need to improve funding elements inside 2022, but cutting-edge ownership arrangements and you can dated statutes create hurdles for loan providers and you may homebuyers. Which restrictions using eg homes immediately whenever all the way down-costs choices are frantically expected.

Label We ‘s the merely federal system made to increase availableness so you’re able to personal property funds-the type of borrowing from the bank one are formulated home buyers can apply having when a property are owned alone on the belongings. In these instances, a bona fide property mortgage is not possible. The market industry private possessions money has not been competitive. However, this type of change to Label I loan constraints and you can financial requirements will help to would green options to have loan providers and grow credit access to have tens and thousands of Americans in search of lowest-pricing land. Additional updates you are going to further bolster the marketplace for including credit.

Lessons learned away from federally supported mortgage software

Federal mortgage applications play a significant part for making a competitive financial sector with tens and thousands of lenders. Specifically, FHA brings insurance to have loan providers and you can enhanced accessibility borrowing from the bank getting individuals that eligible for mortgages purchasing are made land. The knowledge implies that denial cost are reduced getting FHA fund than just he is to own mortgage loans rather than government insurance coverage; over 1 in step three are designed-mortgage loan borrowers overall put one FHA loans.

However, absolutely nothing similar exists for personal possessions financing. Instead a source of government support, few loan providers engage and you can couple individuals was accepted. In fact, just four lenders produced 78% away from private property money out of 2018 through 2022. Such as focus means these firms provides enough market power-and you will almost two-thirds from loan requests was indeed refused throughout that several months.

However, compatible position on Term We program could help complete the latest pit and invite the fresh FHA playing an equally essential character during the starting a functioning marketplace for federally backed private property funds.

FHA develops loan limits to better line-up that have newest construction rates

Under the Term I system, recognized lenders can offer credit inside particular loan constraints so you can eligible borrowers to shop for a manufactured house with or with no purchase of the brand new parcel where in fact the structure might be discover. Financing restrictions was not increased as 2009, but average houses pricing enjoys nearly doubled prior to now 10 years.

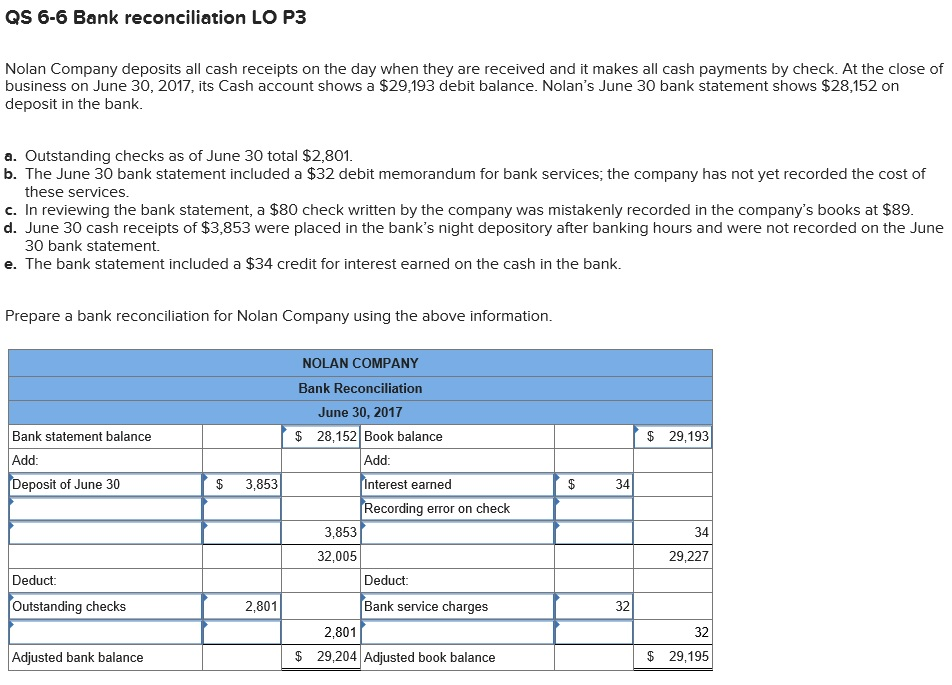

To handle it, FHA is expanding loan restrictions within its Identity We program in order to maintain with home values. Brand new service tend to today lay various other mortgage constraints, depending on whether or not the residence is one-part or multi-point (twice or huge). That it alter increase financing restrictions to own multiple-section home because of the on the $125,000, if you are limitations getting unmarried-point property will increase from the more $thirty five,000. Because of this, tens of thousands of household which were previously shut-out of the applying on account of reasonable loan restrictions commonly actually have the latest accessibility to obtaining the new Title We system. Further, loan restrictions was up-to-date per year so as that mortgage numbers sit aligned with home values, that is critical for this new program’s prolonged-identity achievement. (Select Contour step one.)

Ginnie Mae decreases barriers getting loan providers making finance

The second tall policy alter is created by Ginnie Mae, and therefore cashadvancecompass.com signature select installment loans encourages homeownership because of the connecting the new U.S. houses , Ginnie Mae set rigorous limits to have are produced family lenders, assuming higher amounts of loan losings. The goal were to top balance risk and you may credit access, although constraints required loan providers to hold an online property value $10 million together with number comparable to ten% of all of the outstanding Title I obligations for are manufactured home financing-4 times more than the new wide variety needed for mortgage lenders.

The loan world has listed that the discrepancy caused good significant impediment to even more loan providers originating Term We finance and securitizing them because a good Ginnie Mae issuer. Already, simply a number of lenders participate in Ginnie Mae’s ensure system to own Name We, without loans have been made in recent times. In contrast, 99% of all FHA single-members of the family mortgages (in addition to those having are produced house) have fun with Ginnie Mae’s make certain. Into the Feb. twenty eight, Ginnie Mae announced the initial regarding a few modernizations. Significantly, the loan guarantor are coming down bank online worth requirements to fall into line directly having its home loan ensure program. Cutting these types of criteria was an option action so you can helping a whole lot more lenders to topic individual possessions finance.

Way more condition perform increase lender adoption and user protections and reduce default exposure

The changes generated so far can help to revive the market to own federally supported individual possessions funds, but there is alot more work to perform. FHA has numerous other opportunities to up-date Label We to minimize barriers so you can entry for new loan providers to look at the applying, increase debtor consequences, and relieve standard risk. Brand new department should consider enabling automatic underwriting to have FHA Identity We capital, and therefore greatly decreases the time and will cost you and work out loans. As well, losses minimization procedures (which help borrowers who happen to be about to their mortgage costs avoid losing their homes) are required having FHA mortgages and really should meet the requirements for Identity I financing too.

Additionally, the brand new department you’ll improve home stability and reduce default chance to have the 50 % of individual possessions mortgage borrowers whom shell out so you can book their homes. Although the Label We system has some criteria set up currently, there are many more property rent defenses that FHA you may consider. Like, Freddie Mac, the federal government-paid organization (GSE) one to acquisitions funds as well as Federal national mortgage association, adopted eg defenses for many who book home ordered playing with financing owned by sometimes of these two GSEs, Fannie mae and you will Freddie Mac computer.

The blend of your condition simply produced that more developments with the Title We program you will definitely raise access to individual possessions funds making all of them safe to own individuals when providing a mortgage isn’t really you’ll be able to.

Tara Roche is the project movie director and you may Rachel Siegel is actually an excellent older manager on the Pew Charitable Trusts’ casing coverage initiative.