six Payday loans Debt relief Alternatives: Methods to Care for Payday cash

In Canada, over the past year, sites looks for payday loans have been increasing. They outnumber searches for another types of financing also mortgages, student loans, combination finance, and car and truck loans. Yet not, as you have most likely heard, an instant payday loan was challenging organization.

Payday loan, labeled as a wage advance, are a magic pill which can be high chance. Precisely why they are so popular is due to its proportions and you may entry to. Pay day loan try to have lower amounts, he’s most simple to qualify for and also you get currency right away.

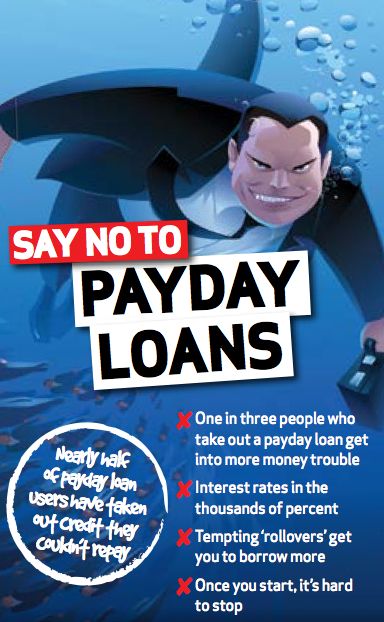

Once you get their paycheck then you certainly pay back the loan. Songs a great best? Not very punctual, there is certainly a big connect. These loans has actually an average of eight hundred% from inside the desire.

He is ended up selling since payday loans you should buy in the a keen emergency to take you by way of up until pay-day. However, we find yourself are determined by such payday money and work out comes to an end fulfill. They results in a diminishing salary. Each month you may have reduced to pay till, the loan could be the size of a complete salary. A lot of men and women have been trapped within upward spiral regarding debt.

These businesses is low-bank lenders and address the fresh economically insecure certainly one of neighborhood. He is built to be studied out over a brief period of energy however, users have a tendency to get stuck from the unanticipated costs. As well, even over one to short period the new 400% attract most accumulates. As an instance, a loan away from $five-hundred will become $one thousand over one fourth seasons. Which is one hundred% demand for merely 3 months!

Pay day loan also have has just gained popularity during the a separate demographic. If you have a young child from inside the college or university you need to know you to younger college students who’ve college loans now use payday loans on a surprising price. College students obtain student loan inspections at set minutes. However, sometimes it happens too-late for rules that they you desire including room and you may panel. This is why, it seek out new magic bullet of payday advance.

These finance has actually a quick turnaround going back to repayment and costly charge. That it often catches as much as their economically insecure target market. Rather than enabling they frequently plunge an individual to the better financial obligation.

The newest pay day loan feels like getting a band-services towards an unbarred wound. It’s a magic bullet, maybe not a permanent services.

From the podcast lower than, the Authorized Insolvency Trustee, Matthew Fader addresses payday loans, the dangers associated with the her or him, therefore the pay day loan debt relief options they give you in order to readers.

My personal Payday loans Was An uncontrollable Personal debt Exactly what Can i Create?

Should your very own payday advances possess received spinning out of control they could be time and energy to find loans assist. There are various methods that relieve you of loans Thornton your expense. The initial step is to pick an authorized Insolvency Trustee, otherwise Lighted having short. Speaking of financial obligation and you can bankruptcy gurus authorized in the Canada. They’ll analyze your debts thereby applying among the pursuing the tactics:

step 1. Credit Counselling

Borrowing counselling brings studies to the proper money administration. They supply pointers and you can recommendations that can help you with budgeting. They educate you on just how to properly explore debit and credit cards. Lastly, credit therapy can help you heed your debt cost plan.

2. Debt Management

An enthusiastic Lighted helps you do a personal debt government bundle. They are available for individuals who can still pay their bills more a longer period of time. Their unsecured outstanding debts try pooled with her with the you to definitely commission that’s divided between your creditors.