Your own Action-by-Step Help guide to The loan Processes

Understand how to prepare your funds, see loan possibilities, and you can improve credit standing. Our very own book empowers you to definitely build informed behavior, guaranteeing a flaccid roadway to your obtaining your dream house.

Unlocking the complexities of your own real estate loan processes is challenging, but worry maybe not. All of our comprehensive publication navigates you due to per home loan processes action which have understanding and you may trust. Off app in order to closing, discover the steps inside, demystifying your way so you’re able to homeownership. Don’t let suspicion stall the aspirations; embark on your own homeownership journey armed with knowledge and you can certainty. Plunge towards the step-by-action mortgage processes book today.

Budgeting: Present Your financial Limits

Establishing monetary limitations is the key when preparing mortgage loan techniques. Our guide on cost management equips your which have crucial techniques to strengthen your financial foundation. Learn to evaluate money, expenditures, and you will discounts effectively to choose their credit potential. By the means clear economic restrictions, you could hone your home search, making sure they aligns along with your funds and a lot payday loans without checking account in St Florian AL of time-term desires. End downfalls and you will way too many be concerned because of the proactively handling your money. Encourage on your own on studies in order to navigate the mortgage financing process with certainty. Begin the journey on the homeownership that have a strong budgeting package from inside the put.

Preapproval: Rating Preapproved for a loan

Protecting preapproval try a crucial step-in the borrowed funds financing acceptance process. The publication illuminates the trail so you can acquiring it important milestone that have convenience. Find the benefits of preapproval and how it streamlines their homebuying trip. Find out the requirements, files, and items you to determine preapproval conclusion. Armed with this information, you can strategy lenders with certainty, once you understand you happen to be prepared to have demostrated your creditworthiness. By getting preapproved, you gain an aggressive border throughout the housing marketplace, showing your severity in order to vendors. Usually do not navigate the borrowed funds mortgage acceptance techniques thoughtlessly; empower your self that have preapproval and pave the best way to homeownership victory.

Family Search: Pick Your perfect Family

Carry on your house query excursion with confidence, armed with essential strategies to discover your dream domestic. Our very own guide unveils the tips for navigating the new housing industry efficiently. Can focus on your position, assess neighborhoods, and you may control resources effectively. Whether you are trying to a cozy bungalow or a modern condominium, find professional suggestions to improve your search. Out-of on the web postings to open properties, grasp the art of spotting invisible gems and you will to avoid prospective issues. With your suggestions, you are able to method domestic browse that have clarity and you may objective, inching closer to the fresh home of fantasy domestic. Start your research today and you can open the doorway to help you homeownership bliss.

Choosing a lender: Get the Most useful Home loan Vendor

Choosing the right bank is a must in the protecting the best financial to meet your needs. All of our publication allows your into studies and also make a knowledgeable choice. Can compare prices, charges, and you can customer care reputations to understand the ideal financial vendor. Discuss different varieties of loan providers, out-of antique financial institutions in order to on the web lenders, and you will consider the huge benefits and you may cons of any. By wisdom the options, you can negotiate with full confidence and you can safer positive terms. Try not to settle for the initial give; with the guidance, you are able to navigate the fresh financing landscape without difficulty, making certain a smooth and you will rewarding credit sense. Choose prudently and you will pave the best way to homeownership achievements.

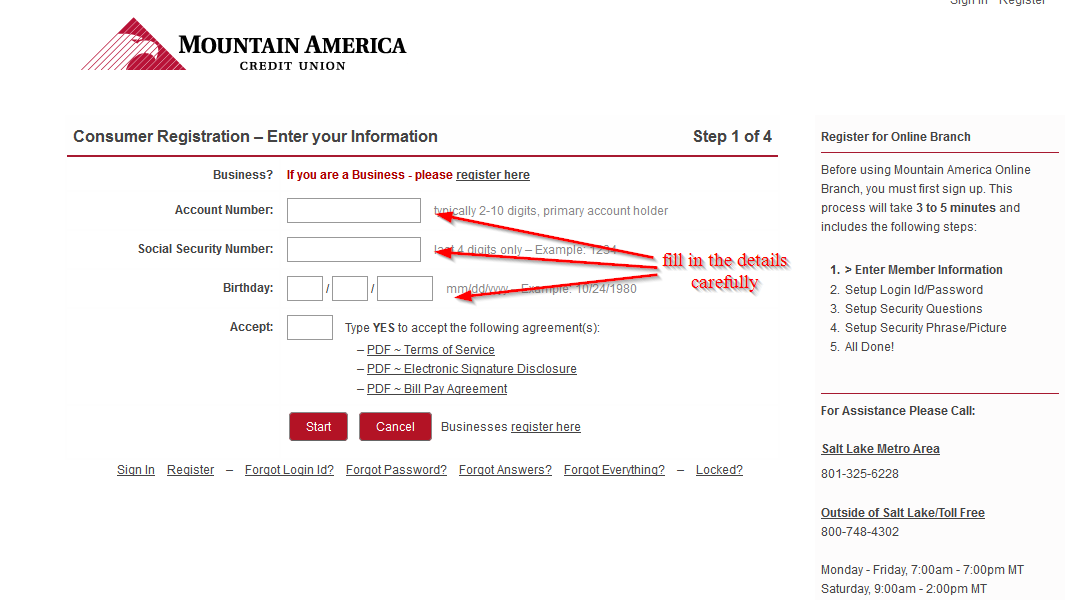

Mortgage Software: Submit an application for Your home Mortgage

Navigating the borrowed funds loan application techniques is actually a pivotal step on homeownership. All of our total book equips your for the systems so you can navigate which excursion with full confidence. Find out the particulars of the application processes, out-of meeting needed records to expertise bank standards. Pick solutions to optimize your software and increase your odds of acceptance. With the help of our professional advice, you can easily browse compliment of papers and functions seamlessly, ensuring a delicate software sense. Embrace mortgage automation in order to streamline employment and you can increase results. Do not let uncertainty impede how you’re progressing; go on your own homeownership excursion today on the training to help you with certainty submit an application for your property financing.